By Sondra Barrett, President and the Board of Directors of NAIBRS

March 15, 2020 Newsletter

We live in uncertain times. We are bombarded with news of Coronavirus spreading in every continent except Antarctica. We are certainly going to break 100,000 infected and 3,000 mortalities….and quite frankly, it is terrifying. I’ve talked to so many friends, relatives and colleagues on how the virus has gone from a remote risk to a local concern. There are comparisons to the Spanish Flu of 1918. Most are shocked at 51 million fatalities caused by the pandemic virus. Many are more shocked when you think our world population was much less than today 102 years ago (less than 2 billion vs almost 8 billion today).

I’ve been thinking about what this will do to our real estate industry…one of the core engines of driving our US economy. Thus, I am writing to you about what our thoughts are on the impact of Coronavirus on our real estate business.

Home prices still remain strong.

Most markets in the US are still going up. There is over 3.3M shortage of housing inventory (per Freddie Mac) and we all keenly understand that homes go up over time. History has shown blips (like a major recession) but prices tend to go up. After all population grows, but land availability does not. Coronavirus will be contained and will be under control as the world if focused on the solution, versus denial and assigning blame.

The Fed Takes Action as a Response to the Impact of Coronavirus

With concerns on an economic slow down, the fed dropped rates 50bps. What this means for us…mortgage rates fell to incredibly low amounts…low 3% range for 30 Year Fixed and some cases below 3% for 15 Year Fixed. This means our clients can afford more house. For example, if rate is lower by 1%, this improves monthly payment by 12%. Your buyers (with prequalification from solid lenders) can buy more homes and save money.

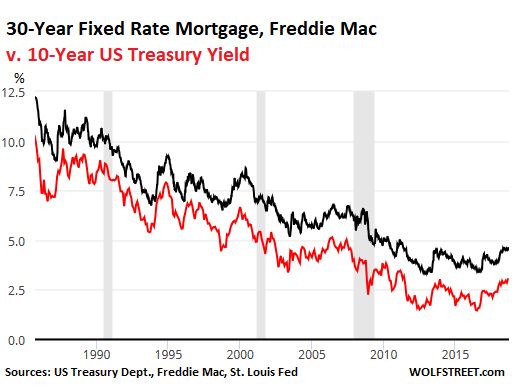

Take a look at this chart of 10-year treasury rates, which are closely linked to mortgage rates.

10-Year US Treasury Rates

(Source: Google)

Many of you are thinking….are 10-year treasury rate and mortgage rates really connected? Yes, they are very much tied together as the next chart shows how tight they follow each other!

Looks like there is a positive correlation!

What to do Now

By being in a digital work environment, we have advantages available today.

Our New Construction Specialist classes for designation are online.

Proposed Properties LLC has its new construction discovery sessions available on Zoom tele-conferencing.

Be positive– if you look worried then your clients will be worried.

Some Beacons of Hope

Tom Truong, 2019 national president of AREAA believes “We remain confident in the housing market and are optimistic that the combined countermeasures including lower interest rates and high homebuyer demand will make 2020 an outstanding year for our industry!”

Asa Fleming, president of NC Association of Realtors with 47,000 agents states “The demand for housing is extremely strong in my state, and I hear similar feedback from other states.

Per Treasury Secretary Steven Mnuchin, the Treasury Department expects to continue “limited and tailored government support” of Fannie Mae and Freddie Mac after their departure from federal conservatorship. “Stability in the housing finance system is crucial, and there should be no disruption to the market as a result of Treasury’s recommended administrative reforms.”

Jim Pesavento, director of NAIBRS states “We have faced more challenges in our lifetime and this too will pass.”

The Ultimate Advice

There will always be a possibility of a global risk that affects our assets. Just look at the stock market with daily drops where many 401K values are dropping like a rock. However, people don’t live in their 401Ks…they live in their homes.

You can’t change how fast we will find a cure…but you can choose to take advantage of incredibly low mortgage rates and get into your dream home.

Life is too short to stop living. Like all storms, Coronavirus will come to pass and we will be back on the steady road to wealth creation for our clients.

Best,

Sondra Barrett

President, NAIBRS